SAVIX.

A perfect collateral for decentralized finance

With Savix a virtual currency is now available for the first time, which makes it possible to profit from staking rewards while keeping the token unlocked and liquid, freely available for use in any DeFi product at the same time.

Protocol Embedded Staking (PES)* used here is deeply anchored in the base code of the currency and does not require any explicit control or triggering by the user. All wallets holding Savix tokens automatically and permanently take part in the staking process.

All contracts and tools needed for deployment are fully developed and in the last steps of internal auditing. At the moment the contracts are running smoothly on the Rinkeby testnet. We plan to switch to mainnet in the beginning of December 2020.

If you’d like to stay up-to-date, please visit our website and join our social channels (see end of this article).

The Vision

Our main objective is to let users profit as much as possible from the new investment opportunities created by decentralized finance with as less barriers as possible. Therefore users combine multiple income streams while keeping full flexibility of token usage. The staking mechanism built into the Savix protocol works without any need for user actions. Users don’t have to lock their tokens and don’t have to claim their rewards since the staking process works completely automated.

We believe that Savix is the best collateral for decentralized finance because, it is

1. Multi-Beneficiary

Since Protocol Embedded Staking (see next paragraph) allows complete availability of token usage in other DeFi products, rewards can be “doubled” using Savix. This way staking rewards work like an extra Layer of passive income. The upcoming liquidity incentive program “Trinary” (see 7) will offer Savix holders another distinctive additional income stream.

2. Convenient

Savix staking is embedded within standard ERC20 transfer functions and is fully automated and 100% passive with no need for user decisions or interactions to receive rewards therefore.

3. Flexible

Savix is compatible with any Ethereum based DeFi project. Savix coins can be used like all standard ERC20 tokens for pooling, lending, yield farming, mining and so on, all this while continuously yielding additional staking tokens to holders.

4. Fair

Savix protocol embedded staking evenly adjust all balances according to the embedded supply development curve. No preference whatsoever is given to any specific holder. All wallets are treated in the same way, independent of balances, transaction volume or other parameters.

5. Transparent

Savix sources are open. All program codes and contracts are made available through Github and can be inspected and tested by anybody. Due to single contract deployment any manipulation of the contract logic or maximum supply is impossible, no minting of additional coins. Staking rewards are fully transparent and predictable.

6. Stable

With Savix there aren’t any reward releasing events at the end of locking periods which could generate cyclical dumps. Except for market reasons selling Savix is never easier or more profitable at any specific point in time, creating less volatility.

7. Independent

With Savix you stay independent because tokens always stay liquid while earning rewards (no locking) and can be freely moved or invested into other DeFi products.

What is Protocol embedded staking?

In order to realize the staking features mentioned above the staking mechanic has been embedded into the ERC20 protocol. The algorithm works by regularly inflating the total token supply according to a mathematical logic implemented into the smart contract. Account balances are defined by their individual share of the total supply thus guaranteeing a non-dilutive allocation of tokens. This way the relative staking profit is and remains equal for all accounts independent of size and user related parameters like staking duration, choice of staking pool etc.

The mathematical logic forming the basis of Savix’s protocol embedded staking follows the following characteristics:

• Transparent supply calculation predictable for investors

• Stability of the calculation towards user behavior and network effects

• Effectiveness of the calculation regarding computing power and transaction costs

The Savix supply development curve is the best combination of these characteristics. Supply development is gradually defined by a sequence of straights (gradient) which determines the interest rate at a specific point in time. Start and end points (corner points) of these straights define the global shape of the supply curve. Each straight is defined by the equation:

F(x) = (Xt — X1) * [(Y1 — Y1) / (X2 — X1) ]

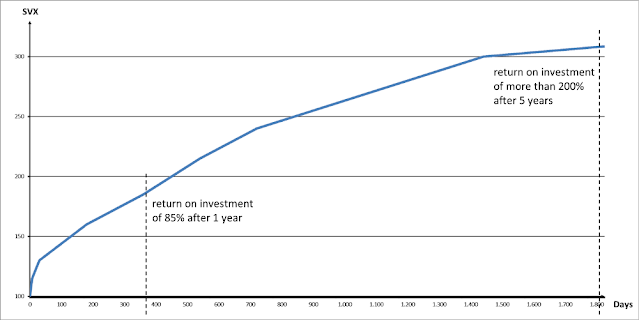

The following diagram shows the temporal development of a starting investment of 100 SVX.

This absolute transparency of temporal development of staking rewards leads to the fact that no special stimuli for token dumping arise at any specific moments, whereas common staking technologies require a locking of tokens often combined with a certain minimum locking duration. After locking periods the probability for sales of large token amounts is heavily increased. The Savix staking automatism does not stimulate any dumping situation of such kind.

Token Technology

Since using DeFi applications (like participating in Uniswap liquidity pools) is a main usage scenario for the Savix token, an implementation as ERC-20 token is required. Non-fungible tokens may play an important role within future concepts and the ERC-721 or ERC-1155 standards may come into use for future developments as well.

However, the Savix token itself will remain untouched by all future developments. These will be designed as separate contracts interacting with the Savix original contract. The immutability of the Savix contract implementation is guaranteed and an important part of Savix`s trust building concept:

• Absolute transparency and liability of contract code due to single contract deployment (no unforeseen changes whatsoever can be made to the staking parameters).

• Absolute transparency and liability of staking rewards due to non-dilutive staking rewards defined by an immutable supply map (future interest rates can be exactly predicted)

• Absolute accuracy and transparency of total circulation supply. The circulating token supply is always identical to the total supply of tokens, there are no tokens held back in any way. The only exception are unsold tokens during the presale (6 month locking time)

What do we plan in the future?

We intend to integrate as many DeFi investment opportunities as possible in a simple-to-use Dapp for all Savix users. In our view, profiting from new way of income by decentralized finance should not stay reserved for users who are particularly tech-savvy.

Savix “Trinary” will be the first element of this Dapp demonstrating the power of ERC20 embedded staking:

Users receive ETH for providing liquidity on automated market making platforms (AMMs) like Uniswap. The more liquidity you provide, and for longer, the greater share of the ETH pool you receive.

Learn more about the project:

Website: https://savix.org/

Telegram: https://t.me/savix_org

Twitter: https://twitter.com/savix_org

Whitepaper: https://savix.org/wp-content/uploads/2020/11/SAVIX_Whitepaper.pdf

For documents and media see: https://savix.org/media

Medium : https://anatol69.medium.com/

Github : https://github.com/SavixOrg

AUTHOR

Bitcointalk Username:Dragonbal58

Telegram Username:@Dragonbal58

Bitcointalk Profile Link:https://bitcointalk.org/index.php?action=profile;u=2433951

ERC20 Wallet:0xfc8C7417f2D808077cbBBF7B4f62A104b7603B57

Komentar

Posting Komentar